12 Mistakes with Vacation Home Ownership

12 Mistakes Families Make When Buying a Vacation Home

Investing in vacation home ownership is an exciting decision, but common missteps can turn a dream into a financial burden. With smart planning, real estate investment can generate generational wealth while maximizing asset protection strategies and tax benefits. Here’s how to avoid costly mistakes.

1. Underestimating Total Costs

Many overlook ongoing expenses like maintenance, property taxes, and management fees. At Rocky Ledge Estates, our owner-builder strategy avoids excess developer costs, and our limited partnerships ensure optimal tax structuring.

2. Ignoring Rental Potential

Families fail to assess a property’s short-term rentals viability. Our private resort homes are designed for large groups, offering event-ready infrastructure and consistent rental demand.

3. Overlooking Legal and Tax Structures

A poorly structured purchase can expose families to unnecessary risks. LLC structuring and limited partnerships provide liability protection while maximizing real estate tax benefits through Corporate Services of Nevada.

4. Failing to Consider Management Needs

Owning a vacation home requires time and oversight. Our in-house property management ensures smooth operations, while digital tracking tools provide real-time financial updates.

5. Not Researching Local Laws

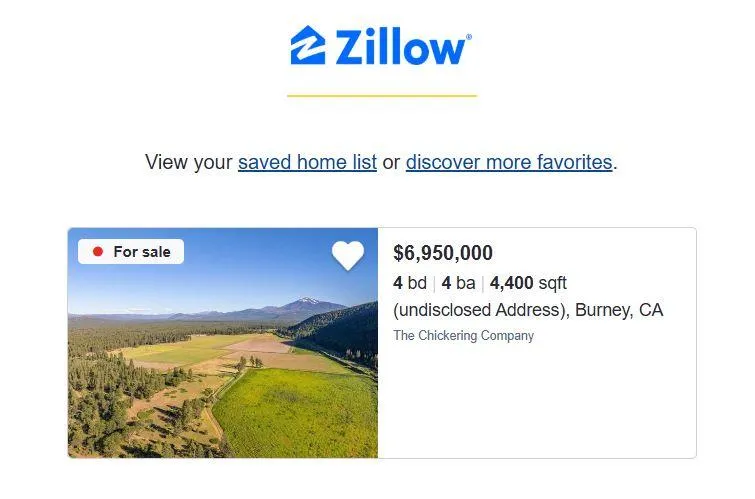

Restrictions on Airbnb investing can impact income. Our Shasta County location is zoned for high-yield vacation rentals, ensuring compliance and strong rental returns.

6. Skipping Professional Inspection

New buyers often overlook structural issues. Our properties feature slab-on-grade construction, OmniBlock walls, and radiant heating, eliminating costly future repairs.

7. Overextending Finances

Stretching budgets to buy a dream home leads to financial stress. Our tax-efficient real estate model uses estate planning techniques to safeguard wealth.

8. Misjudging Long-Term Value

Smart investors prioritize family wealth planning and sustainability. Our homes are ADA-compliant, ensuring usability across generations.

9. Focusing Solely on Emotion

Buying based on sentiment, rather than investment fundamentals, can lead to poor returns. Our real estate investment model blends personal enjoyment with financial security.

10. Forgetting Future Lifestyle Needs

Life changes, such as aging parents, require forward-thinking design. Our single-level homes cater to all stages of life, enhancing financial legacy planning.

11. Neglecting Asset Protection

Without the right legal structures, family assets are at risk. Our LLC structuring and limited partnerships ensure long-term security while reducing personal liability.

12. Overlooking Tax Implications

Many miss out on real estate tax benefits. Our corporate services maximize deductions while ensuring compliance with IRS regulations.

The Smart Way to Build Family Wealth

Avoiding these mistakes ensures vacation home ownership remains a valuable real estate investment. At Rocky Ledge Estates, we guide families through asset protection strategies, LLC structuring, and investment property planning to create a legacy that lasts. Contact us today to secure your future.