Top 10 Reasons to become a Limited Partner

Bonus Depreciation

Our LP structure allows you to take the Bonus Depreciation on the portion of your investment that is used for capital improvements. 100% of your investment is used for construction that builds equity and locks in the lowest property taxes under Prop 13. Ideal opportunity to convert from Crypto or Stocks and the Capital Gains Tax is paid with a deduction!

Debt Free Resort

Profit to the LP members in a K-1 to their business that owns the resort. $10M financed today would require a $90,000 per month payment to the bank for 15 years. Our powerful strategy converts all that passive income into K-1 distributions.

Asset Protection - Generational Wealth

Land held by an LLC holding company that is the capital contribution from the General Partner of the Limited Partnership.

The LP provides the same advantages of owning any stock.

Your own Family Business

Owns the 6.25% of the LP and your death will not force a title change that always triggers higher taxes and lowers the inheritance to your heirs. With this legal structure managed for compliance by Corporate Services of Nevada, your legacy stays with your family business. They choose how to use the K-1 distributions.

No hassle ownership of a luxury vacation property

Let’s face it, $1.250,000 in California for 4,300 sq./ft. 6 Bedroom/6 Bathroom on a gated 4 to 5 acre estate with National Forest in your backyard would be a bargain. Our LP pays all the bills for you and maintains the property while providing Five-Star onsite concierge services to all guests without you lifting a finger. This is unprecedented. The LP’s view daily updates on their phone using an APP that allows you to see "before and after" cleanings, calendar bookings, and our CPA uses the online transactions to pay bills, prepare taxes, and issue K-1’s to all the LP’s.

General Partner has a 50% stake

Half of every dollar spent, and half of every profit distribution is part of his family legacy. The LP pays no fees for this GP. The GP is compensated as the CEO of the Rocky Ledge Development & Hospitality company that belongs to the LP.

Owner-builder - "Build to Rent" - Family driven

As a new local contracting company that seeks distribution agreements from all our suppliers and passes the savings to the LP. Shasta County Building Department inspects all phases of construction and RLD&H will hire the best construction experts as full time employees that live in our community. A contractor charges more than 30% and requires “change orders” for any improvement in the build. We avoid all this by using a Licensed Contractor as a consultant and we are owner-builders, with a team of professionals that are building their showcase for a future in our rural community. Our competition will need to pay the costs for travel. We save big when we disclose our employment expenses when we are issued our final occupancy permit. For example, $1M spent on 8 professionals who build our 8 estates, will report a $125,000 per parcel expense. The lower the build costs, the lower the property tax.

CC&R’s and no HOA

The recorded CC&R’s allow for four horses per estate and the county STR rules empower private residential property owners while Shasta County collects a 10% occupancy tax that is paid by our renters. The Burney Chamber of Commerce wants our success!

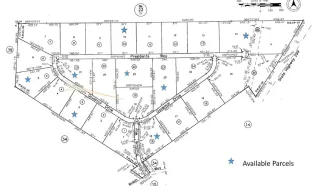

Location - Four Seasons - National Forest - Direct access from Highway 299

Direct access to National Forest, Great Shasta Rail Trail and Pacific Crest Trail - Del Oro Water meter at the curb, approved “build ready” parcels, paved streets, elevation 3,182, Outdoor Adventure Capital of Northern California, 2.5 Hours from Reno International Airport, 17 minutes from Fall River Mills Municipal Airport, 4-5 hours from Bay Area, Ski Mt. Shasta, fish Hat Creek, explore Lassen Volcanic National Park, Horses welcome, Pets welcome, Up to 16 guests per Private Resort Home. LP's share a Serenity Haven Cottage for six weeks each year!